Preview: Residential Property Tax One-Pager

Below you will see an excerpt of our Residential One-Pager on residential property taxes, written by our

managing partner Chase Koska.

Click here to download the full PDF.

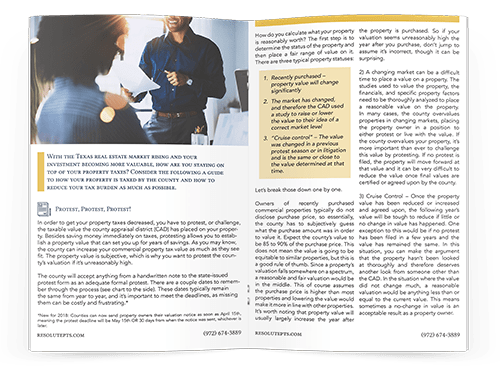

With the Texas real estate market rising and your property becoming more valuable, how are you

staying on top of your property taxes? Consider the following a guide to how your property is

taxed by the county and how to reduce your tax burden as much as possible.

Right to Protest

As a homeowner, your biggest monthly expense is most likely to be your mortgage. For the average mortgage holding Texan, 35-55% of that monthly mortgage payment is just for property taxes. And while Homestead Exempt residences have certain protections and safeguards, that sometimes isn’t enough. Thankfully, the Texas Constitution allows you to protest and appeal your property basis each year. Even better: Resolute Property Tax Solutions can tackle this challenge for you!

How Does Resolute Work?

We offer full service representation to our residential property owners. We’ll file the appeal, review and create evidence using our proprietary software, meet with the appraisal district, negotiate for the appropriate value, and present your case before an appraisal review board if needed. We also offer binding arbitration and litigation support services should your case need to go a step further.

What does this cost?

It's simple. We charge a contingency fee based on what we save you. No savings, no fee due. This gives Resolute all the reason in the world to reduce your property taxes as much as possible.

About Resolute

Resolute Property Tax Solutions is an industry leader in Property Tax Consulting. Our team of Property Tax Consultants is committed to saving you money by attaining the lowest possible assessed value for your commercial, residential, or business personal properties. At Resolute we are experienced,

knowledgeable professionals who always stay well-informed on the latest Tax Code changes in order to maintain our superior customer service. ...

There's much more where that came from!

Click here to download the full PDF.

Residential Property Tax Protests

Below is more general residential property tax protesting information. Contact us today and put year-after-year property tax savings on autopilot.

Property Taxes - How to Mitigate Potential Loss

Understanding Your Rights and Maximizing Your Property Tax Savings with Resolute

As a residential property owner in Texas, you have the right to protest your property taxes annually. This right is enshrined in the Texas Tax Code, specifically under sections such as **Texas Tax Code §41.41 and **Texas Tax Code §41.44**, which outline your ability to contest the appraised value of your property and the procedures for filing a protest. At Resolute, we specialize in helping homeowners navigate this complex process to ensure they pay only their fair share of property taxes.

Why Protest Your Property Taxes?

Property taxes can be a significant annual expense, and often, the appraised value of your property may not accurately reflect its true market value. By protesting your property taxes, you can potentially lower your tax bill, freeing up funds for other important expenses. According to **Texas Tax Code §41.41**, you have the right to protest the appraised value of your property, the unequal appraisal of your property compared to others, and several other determinations made by the appraisal district.

The Resolute Advantage

At Resolute, we leverage advanced valuation optimization software to gather and organize comparable data, ensuring that your protest is backed by solid evidence. Our technology-driven approach allows us to identify discrepancies in your property’s appraisal and present a compelling case for a reduction. This meticulous preparation is crucial, as the success of your protest often hinges on the quality and accuracy of the data presented.

Simplified Process

Navigating the property tax protest process can be daunting, but Resolute simplifies it for you. From filing the initial protest to representing you at the Appraisal Review Board (ARB) hearings, we handle every step. According to **Texas Tax Code §41.44**, the usual deadline for filing most protests is May 15, and we ensure that all paperwork is submitted accurately and on time, so you never miss a critical deadline.

Maximizing Reductions

With Resolute, you’re not just filing a protest; you’re maximizing your chances of a successful reduction. Our valuation optimization software compares your property’s appraisal with similar properties, identifying any overvaluations. This data-driven approach is essential for convincing the ARB to lower your property’s appraised value, as outlined in **Texas Tax Code §41.41(a)(1)**.

Resolute does all this work for you. Our all-in-one service offers the convenience and experience to do the job efficiently and thoroughly.

Comprehensive Support

We provide comprehensive support throughout the protest process. This includes preparing all necessary documentation, attending informal conferences, and representing you at ARB hearings. According to **Texas Tax Code §41.45**, property owners are entitled to an informal conference before the hearing, and we ensure that these opportunities are fully utilized to argue your case.

Transparent and Affordable

At Resolute, we believe in transparency and affordability. Our services are designed to be cost-effective, ensuring that the savings you achieve far outweigh the fees. We provide clear, upfront pricing with no hidden costs, so you know exactly what to expect.

Proven Results

Our track record speaks for itself. We have successfully helped numerous homeowners reduce their property taxes, saving them thousands of dollars annually. By choosing Resolute, you’re partnering with a team that has a proven history of achieving significant tax reductions for its clients.

Take Action Today

Don’t let an inaccurate property appraisal inflate your tax bill. Contact Resolute today to schedule a consultation and learn how we can help you protest your property taxes effectively. Remember, the deadline for filing a protest is typically May 15th, so it’s crucial to act promptly. With Resolute by your side, you can rest assured that your property tax protest is in expert hands.