Notice of Appraised Value

The day has arrived! You look forward to it every year; ok, dread could be a better description for most. In your mailbox is your property’s new Notice of Appraised Value, lovingly constructed, sealed, and sent to you by your local appraisal district. Do you rip it up and throw it away in disgust, or stick it on your refrigerator as a reminder for later like a ‘20% Off Your Entire Purchase’ coupon at your favorite store? Hopefully what you read below will help you decide that. This article takes a deeper look at what the tax code says about the Notice of Appraised Value, how to get the most from them, and why receiving one shouldn’t ruin your whole summer.

Texas Property Tax Code

The rule book when it comes to anything property tax related in Texas is the Texas Property Tax Code. It outlines everything from appraisal methods used, record keeping requirements by appraisal districts, and tax liens for delinquent payers. It’s the Bible of Texas property taxes, and what it says must be followed.

What does the Texas Property Tax Code say about a Notice of Appraised Value? I’m glad I asked. It mentions many things, but some things are WAY more important than others. First, it’s important to know under what circumstances you will receive a Notice of Appraised Value (Notice) from your local appraisal district. Tax code specifically says that an appraisal district is not required to send you an annual appraisal Notice unless: 1) Your new market value for the year is more than $1,000 higher than it was the preceding year -OR- 2) The property in question wasn’t on the appraisal roll, which is the county’s record system, in the previous year -OR- 3) There was a change in the exemption status from the previous year that results in more taxes (PTC 25.19a,e).

You’d be surprised how many people don’t know the ‘$1,000 or greater’ rule and when they don’t receive a Notice they call us up in July and say “can I still file a protest?” The short answer 99.9% of the time is “no, it’s too late to file a protest”. I’ve seen this argument shut-down more times than I can count in a hearing to determine if a late protest should be allowed. Just because you weren’t made aware of your current year value and didn’t receive a Notice, due to one of the three previously listed reasons, doesn’t mean you have valid cause to file a late protest after the protest deadline (which is May 15th for most). In fact, I tell almost anyone who asks me about Notices to ignore the snail mail system and just check their value on the appraisal district’s website starting in early April. Often the county website will tell you everything you need to know including the deadline to file a protest. It may even offer you a digital copy of your Notice.

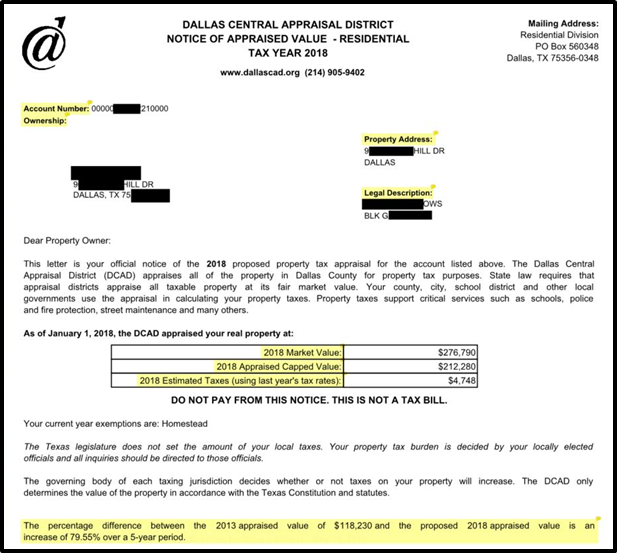

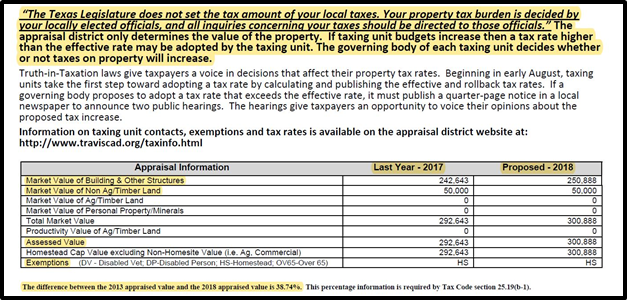

So, what else does tax code say about Notices? Great question. Tax code says that there must be very specific pieces of information on all official Notices. I have to say official Notices because some counties will send unofficial postcards to property owners who are not required to receive an official Notice based on the criteria I mentioned previously. But unlike postcards, true Notices are required to show the following: your property identification, your taxing entities, the current and previous year’s appraised value and taxable value accounting for exemptions, an estimate of taxes based on that value and the latest know tax rates, and a glance of your value from 5 years ago along with the percentage change your property value has made since then. If you have an exemption that freezes taxes for a certain entity, that frozen amount should be indicated as well. The district is also required to break down land value versus improvement value, meaning any structure that has been built on the land itself.

On top of all of that information that is super specific to your property, a Notice will include statements about local appraisal, tax rate creation, and rate adoption. They are required to let you know that property taxes are a local issue so that you don’t call the State to complain about your value or taxes. And they’re right, you won’t get anywhere calling the State about that stuff.

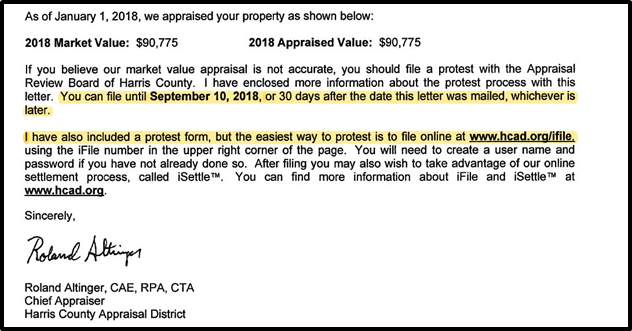

This is all well and good information they are providing, but why shouldn’t I just rip up and throw away this statement? Hang with me, I haven’t mentioned the most important piece of information provided on Notices. All Notices are required to provide detailed instructions on how, by what means, and by when you may file a protest to dispute the current value which includes a Notice of Protest form with instructions on how to complete it and send it back to the appraisal district (PTC 25.19g, j).

What does that mean for me? It means you can protest that value if you aren’t happy with it... regardless of previous years’ value or prior results. Collect sales data, property damage photos, repair bids, and other evidence to make your case (see also How to Protest Your Property Taxes). Property owners are sometimes treated more favorably than property tax agents at the appraisal district; use that to your advantage. Be polite but compelling. You may be surprised with the results of your protest.

Hire The Pros

Or don’t protest yourself and hire a pro to do it for you. You mean like Resolute Property Tax Solutions? EXACTLY! But at least exercise your right to dispute your property value. It’s just like voting. You can’t complain later about your property taxes if you didn’t do anything about them when you had the chance. Well you can, but it’d be insincere and annoying.

At least 20 times a year I hear a prospective client say, “I don’t think I have a good case, why bother protesting?” The simple answer is doing nothing results in nothing 100% of the time when it comes to property taxes. You’ll really never know unless you try. And the beauty of our service, aside from time saved and professional service, is that we don’t charge you a dime if we’re unsuccessful in saving you money. That’s what you would call a No-Lose scenario.

If you would like to have us protest your property taxes on your behalf, then Sign Up.